Federal Spending 3 Guided Reading and Review

Chapter 30. Authorities Budgets and Fiscal Policy

30.ane Government Spending

Learning Objectives

By the end of this section, yous will be able to:

- Place U.S. upkeep deficit and surplus trends over the by five decades

- Explain the differences between the U.South. federal budget, and land and local budgets

Government spending covers a range of services provided by the federal, state, and local governments. When the federal government spends more money than information technology receives in taxes in a given yr, it runs a upkeep deficit. Conversely, when the government receives more money in taxes than it spends in a year, it runs a budget surplus. If government spending and taxes are equal, information technology is said to have a balanced budget. For example, in 2009, the U.Southward. authorities experienced its largest budget arrears ever, as the federal government spent $i.4 trillion more than than it collected in taxes. This deficit was about ten% of the size of the U.S. GDP in 2009, making it by far the largest budget deficit relative to GDP since the mammoth borrowing used to finance World State of war 2.

This section presents an overview of government spending in the United States.

Total U.S. Government Spending

Federal spending in nominal dollars (that is, dollars not adjusted for inflation) has grown by a multiple of more than 38 over the terminal iv decades, from $93.iv billion in 1960 to $3.ix trillion in 2014. Comparison spending over time in nominal dollars is misleading because information technology does not accept into account aggrandizement or growth in population and the real economy. A more useful method of comparison is to examine authorities spending every bit a percent of Gdp over time.

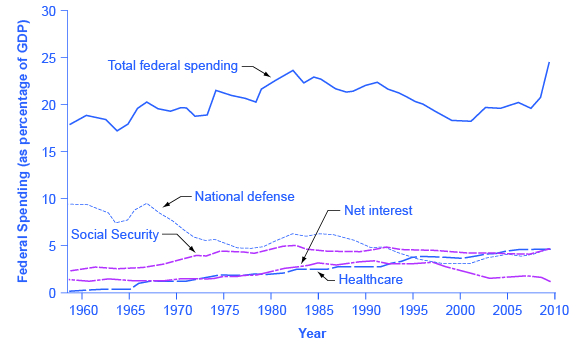

The top line in Effigy one shows the level of federal spending since 1960, expressed as a share of Gdp. Despite a widespread sense among many Americans that the federal government has been growing steadily larger, the graph shows that federal spending has hovered in a range from 18% to 22% of GDP most of the time since 1960. The other lines in Figure 1 testify the major federal spending categories: national defense, Social Security, health programs, and interest payments. From the graph, we encounter that national defense spending as a share of Gross domestic product has mostly declined since the 1960s, although there were some upward bumps in the 1980s buildup under President Ronald Reagan and in the backwash of the terrorist attacks on September xi, 2001. In contrast, Social Security and healthcare have grown steadily as a percentage of Gross domestic product. Healthcare expenditures include both payments for senior citizens (Medicare), and payments for low-income Americans (Medicaid). Medicaid is also partially funded by state governments. Interest payments are the concluding main category of government spending shown in the figure.

Each year, the government borrows funds from U.Due south. citizens and foreigners to encompass its budget deficits. It does this by selling securities (Treasury bonds, notes, and bills)—in essence borrowing from the public and promising to repay with involvement in the hereafter. From 1961 to 1997, the U.S. government has run budget deficits, and thus borrowed funds, in almost every year. Information technology had budget surpluses from 1998 to 2001, and and then returned to deficits.

The interest payments on past federal government borrowing were typically ane–2% of Gdp in the 1960s and 1970s but and so climbed higher up three% of Gdp in the 1980s and stayed in that location until the late 1990s. The authorities was able to repay some of its past borrowing by running surpluses from 1998 to 2001 and, with help from low interest rates, the interest payments on past federal government borrowing had fallen back to ane.four% of Gross domestic product by 2012.

We investigate the patterns of regime borrowing and debt in more than detail later in this chapter, only first nosotros need to analyze the difference between the deficit and the debt. The deficit is not the debt. The difference between the deficit and the debt lies in the time frame. The authorities deficit (or surplus) refers to what happens with the federal government budget each yr. The authorities debt is accumulated over time; it is the sum of all past deficits and surpluses. If you infringe $10,000 per yr for each of the four years of college, y'all might say that your annual deficit was $10,000, merely your accumulated debt over the 4 years is $40,000.

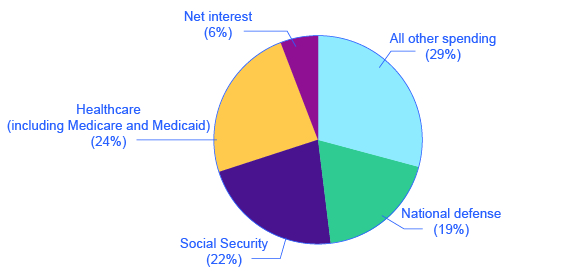

These four categories—national defense force, Social Security, healthcare, and interest payments—account for roughly 73% of all federal spending, as Figure 2 shows. The remaining 27% wedge of the pie chart covers all other categories of federal authorities spending: international affairs; science and technology; natural resources and the surround; transportation; housing; education; income support for the poor; community and regional development; law enforcement and the judicial system; and the administrative costs of running the government.

State and Local Government Spending

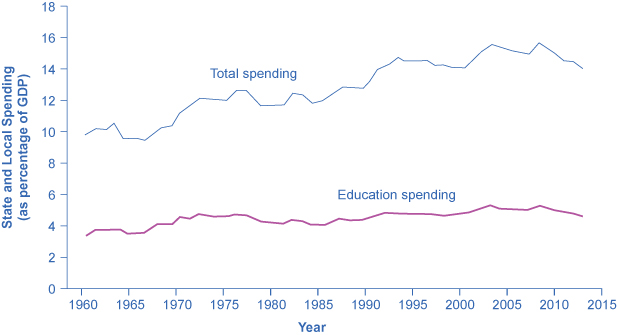

Although federal authorities spending often gets nearly of the media attention, state and local regime spending is besides substantial—at about $3.i trillion in 2014. Effigy 3 shows that country and local government spending has increased during the last four decades from around eight% to around xiv% today. The single biggest particular is education, which accounts for almost one-third of the total. The rest covers programs similar highways, libraries, hospitals and healthcare, parks, and constabulary and fire protection. Different the federal authorities, all states (except Vermont) take counterbalanced budget laws, which means any gaps between revenues and spending must be closed by college taxes, lower spending, drawing downward their previous savings, or some combination of all of these.

U.S. presidential candidates often run for office pledging to meliorate the public schools or to get tough on criminal offense. Even so, in the U.South. organisation of regime, these tasks are primarily the responsibilities of state and local governments. Indeed, in fiscal year 2014 land and local governments spent almost $840 billion per year on instruction (including K–12 and college and academy educational activity), compared to but $100 billion by the federal authorities, according to usgovernmentspending.com. In other words, well-nigh 90 cents of every dollar spent on education happens at the state and local level. A politician who really wants hands-on responsibility for reforming education or reducing crime might exercise better to run for mayor of a large city or for land governor rather than for president of the U.s..

Key Concepts and Summary

Fiscal policy is the prepare of policies that chronicle to federal government spending, revenue enhancement, and borrowing. In contempo decades, the level of federal government spending and taxes, expressed as a share of Gdp, has not changed much, typically fluctuating betwixt about eighteen% to 22% of GDP. However, the level of state spending and taxes, as a share of GDP, has risen from about 12–13% to about 20% of GDP over the final four decades. The four master areas of federal spending are national defence, Social Security, healthcare, and interest payments, which together account for most lxx% of all federal spending. When a government spends more than than it collects in taxes, it is said to accept a budget arrears. When a government collects more in taxes than it spends, it is said to have a upkeep surplus. If government spending and taxes are equal, information technology is said to have a balanced upkeep. The sum of all past deficits and surpluses make up the authorities debt.

Self-Check Questions

- When governments run budget deficits, how do they make up the differences betwixt taxation acquirement and spending?

- When governments run budget surpluses, what is done with the extra funds?

- Is it possible for a nation to run budget deficits and still take its debt/GDP ratio fall? Explain your reply. Is information technology possible for a nation to run budget surpluses and still have its debt/GDP ratio ascension? Explicate your answer.

Review Questions

- Requite some examples of changes in federal spending and taxes by the government that would be fiscal policy and some that would not.

- Have the spending and taxes of the U.South. federal government generally had an upward or a downward tendency in the terminal few decades?

- What are the master categories of U.S. federal government spending?

- What is the departure between a budget arrears, a counterbalanced budget, and a upkeep surplus?

- Have spending and taxes past state and local governments in the U.s.a. had a generally upwards or downward trend in the last few decades?

Critical Thinking Questions

- Why is government spending typically measured as a percentage of GDP rather than in nominal dollars?

- Why are expenditures such as criminal offence prevention and didactics typically washed at the land and local level rather than at the federal level?

- Why is spending by the U.Southward. government on scientific inquiry at NASA fiscal policy while spending by the University of Illinois is not fiscal policy? Why is a cut in the payroll tax fiscal policy whereas a cut in a state income tax is not fiscal policy?

Bug

A government starts off with a total debt of $three.five billion. In year one, the government runs a deficit of $400 1000000. In year two, the regime runs a deficit of $1 billion. In yr three, the government runs a surplus of $200 million. What is the full debt of the government at the end of yr three?

References

Kramer, Mattea, et. al. A People'due south Guide to the Federal Upkeep. National Priorities Project. Northampton: Interlink Books, 2012.

Kurtzleben, Danielle. "10 States With The Largest Upkeep Shortfalls." U.S. News & World Report. Januray fourteen, 2011. http://www.usnews.com/news/articles/2011/01/14/ten-states-with-the-largest-upkeep-shortfalls.

Miller, Rich, and William Selway. "U.S. Cities and States Get-go Spending Again." BloombergBusinessweek, January ten, 2013. http://www.businessweek.com/articles/2013-01-10/u-dot-s-dot-cities-and-states-showtime-spending-again.

Weisman, Jonathan. "Later on Year of Working Effectually Federal Cuts, Agencies Face Fewer Options." The New York Times, October 26, 2013. http://www.nytimes.com/2013/10/27/us/politics/afterward-yr-of-working-effectually-federal-cuts-agencies-face-fewer-options.html?_r=0.

Chantrill, Christopher. USGovernmentSpending.com. "Regime Spending Details: United States Federal Land and Local Government Spending, Financial Year 2013." http://www.usgovernmentspending.com/year_spending_2013USbn_15bs2n_20.

Glossary

- balanced budget

- when regime spending and taxes are equal

- upkeep arrears

- when the federal government spends more money than it receives in taxes in a given twelvemonth

- upkeep surplus

- when the authorities receives more money in taxes than it spends in a year

Solutions

Answers to Self-Check Questions

- The authorities borrows funds by selling Treasury bonds, notes, and bills.

- The funds tin be used to pay down the national debt or else be refunded to the taxpayers.

- Yes, a nation tin run budget deficits and see its debt/GDP ratio autumn. In fact, this is not uncommon. If the deficit is small in a given year, than the addition to debt in the numerator of the debt/Gdp ratio will exist relatively small, while the growth in GDP is larger, and then the debt/Gdp ratio declines. This was the experience of the U.Southward. economy for the catamenia from the terminate of Earth State of war Ii to near 1980. Information technology is too theoretically possible, although not probable, for a nation to accept a budget surplus and see its debt/GDP ratio rise. Imagine the case of a nation with a small surplus, only in a recession twelvemonth when the economy shrinks. It is possible that the decline in the nation'due south debt, in the numerator of the debt/Gdp ratio, would exist proportionally less than the fall in the size of GDP, so the debt/Gross domestic product ratio would ascension.

Source: https://opentextbc.ca/principlesofeconomics/chapter/30-1-government-spending/

Post a Comment for "Federal Spending 3 Guided Reading and Review"